Market Update - September 29, 2023

This Market Update is written by our Capital Market specialists each week to bring you insight into what's happening in the market and how it may affect mortgage rates and real estate trends.

Market Commentary:

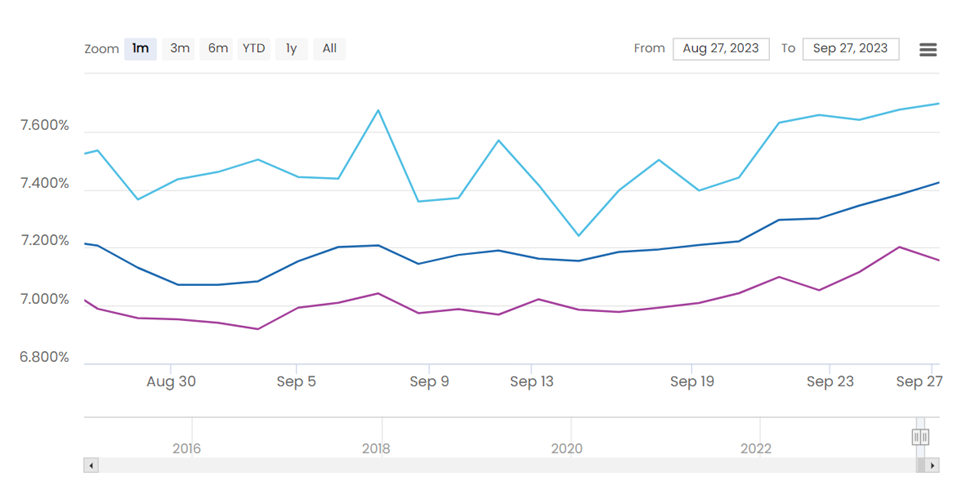

For the week of Sept 22nd – Sept 28th, 30-year and 15-year interest rates increased to the highest level in twenty years. The upcoming release of Personal Consumption Expenditures (PCE) numbers will be a key indicator for The Federal Reserve’s move with regards to interest rates.

The increase reflects a variety of factors, including the Federal Reserve's continuing fight against inflation, rising Treasury yields, liquidity, and the fading prospects of a recession. The central bank decided against another rate hike at its Sept. 20 meeting but left open the chance of another hike before the end of the year. While the Fed doesn't directly set fixed mortgage rates, it does establish the overall tone. The more relevant benchmark for 30-year mortgage rates is the 10-year Treasury yield, which has risen above 4.6 percent.

"Today's high mortgage rates are not the only challenge we have in the current market," said Erin Sykes, chief economist at Nest Seekers International. "The combination of high interest rates plus sustained property prices and persistent inflation are making day-to-day life more expensive."

While experts say mortgage rates are unlikely to return to rock-bottom levels in the early pandemic, there's a good chance we could see mortgage rates dip before the end of the year.

Fannie Mae calls for the average 30-year fixed mortgage rate to close out the year at 7.1%.

Fed Watch: Looking ahead, all eyes are now on the upcoming November 1st Federal Open Market Committee (FOMC) meeting. According to the CME Group, 16.2% of forecasters predict an increase in interest rates, while 83.8% predict rates will remain the same. None of the forecasters expect rates to decrease.

Market Review:

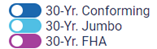

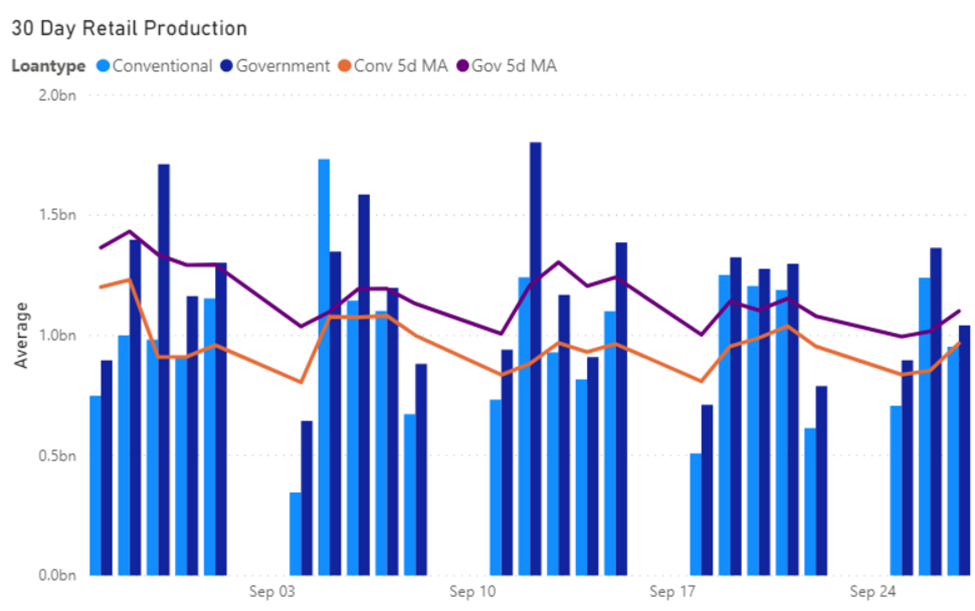

Per Black Knight's Production Metrics, the breakdown of mortgage production volume is as follows: 85.19% for purchase transactions, 12.08% for cash-out refinances, and 2.73% for rate and term refinances.

Per Black Knight 51.33% of all Retail loan production were Government Loans (FHA, VA, USDA), while 48.67% were Conventional and Non-Conforming loans.

News You Can Use:

- US Economy Remains Resilient in Second Quarter; Labor Market Tight

- US economic outlook: a cooler climate as the US economy enters Q4

- Economic Viewpoints: Home Prices Rising Again

- Buydowns and loan assumptions help home buyers bridge affordability gap

- Inflation Adjusted House Prices 3.4% Below Peak; Price-to-rent index is 7.4% below recent peak

- Florida overtakes New York as second most-valuable housing market in U.S.

- How Would a Government Shutdown Impact the Housing Market? Low Demand in D.C., Possible Temporary Dip in Mortgage Rates

- Housing Market 2023: 10 US Cities with Plenty of Jobs and Cheap Housing

*Communication is intended for Industry Professionals only and not intended for Consumer Distribution

Interest rate and annual percentage rate (APR) are based on current market conditions as of 09/28/2023, are for informational purposes only, are subject to change without notice and may be subject to pricing add-ons related to property type, loan amount, loan-to-value, credit score and other variables. Estimated closing costs used in the APR calculation are assumed to be paid by the borrower at closing. If the closing costs are financed, the loan, APR and payment amounts will be higher. Contact us for details. Additional loan programs may be available. Accuracy is not guaranteed, and all products may not be available in all borrower's geographical areas and are based on their individual situation. This is not a credit decision or a commitment to lend. actual interest rate, APR, and payment may vary based on the specific terms of the loan selected, verification of information, your credit history, the location and type of property, and other factors as determined by Prosperity Home Mortgage, LLC. Not available in all states. Rate is as of 09/28/2023 and is subject to change at any time without notice. Opinions, estimates, forecasts, and other views contained in this document are those of Freddie Mac's economists and other researchers, do not necessarily represent the views of Freddie Mac or its management, and should not be construed as indicating Freddie Mac's business prospects or expected results. Although the authors attempt to provide reliable, useful information, they do not guarantee that the information or other content in this document is accurate, current, or suitable for any particular purpose. All content is subject to change without notice. All content is provided on an "as is" basis, with no warranties of any kind whatsoever. Information from this document may be used with proper attribution.