Market Update - April 26, 2024

This Market Update is written by our Capital Market specialists each week to bring you insight into what's happening in the market and how it may affect mortgage rates and real estate trends.

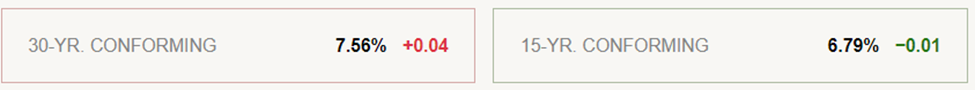

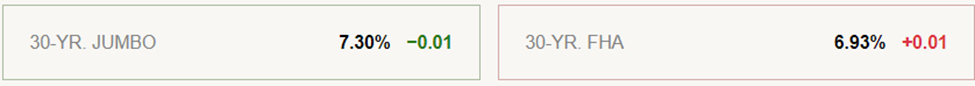

Rates are provided by Housing Wire in conjunction with Polly. Rates are updated in real-time. Polly data is calculated using actual locked rates. Rates are inclusive of locks that occur below par, at par and therefore consider discounts and rebates.

Market Commentary:

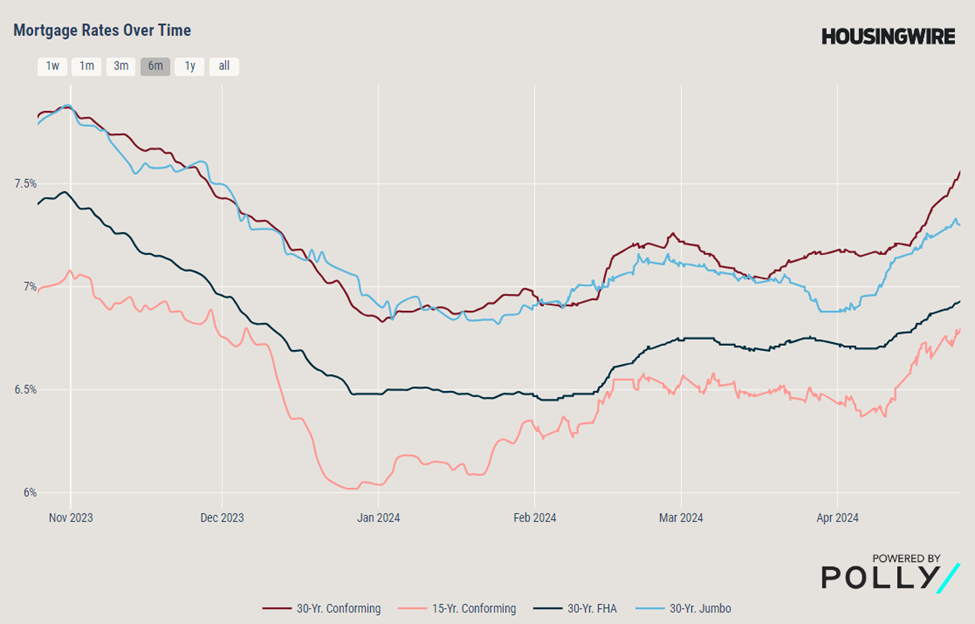

For the week of April 19th to April 25th, interest rates increased. Today’s CORE PCE Price numbers (a measure of how much U.S. households spend on goods and services) came in significantly hotter than expected; an increase of 1.7% from last month. Inflation continues to be a concern and Friday, April 26th CORE PCE inflation numbers will give a direction of where the market is headed. The previous month’s numbers were 2.8%, forecast is 2.6%, and if inflation data comes in higher there is a lesser likelihood of the Fed cutting interest rates any time soon.

Expert Mortgage Rate Predictions:

Most experts expect rates to remain elevated in the near future, with a possibility of some decrease later in the year.

Freddie Mac: Their forecast sees rates remaining above 6.5% at least through the second quarter of 2024.

Fannie Mae: Their revised outlook anticipates a 30-year fixed rate reaching 6.4% by year-end, slightly higher than their previous estimates.

National Association of Realtors: Chief economist Lawrence Yun suggests rates will likely hover between 6% and 7% for 2024. He cites factors like inflation and the budget deficit as contributing influences.

Looking ahead, the predictions for mortgage rates over the next two years suggest a gradual decline. Experts from various financial institutions and housing associations have weighed in, providing a consensus that, while the rates may not see a dramatic drop, there is an expectation of a downward trend.

The Mortgage Bankers Association (MBA) forecasts that the 30-year fixed-rate mortgage will end 2024 at 6.1% and reach 5.5% by the end of 2025. This aligns with the sentiment from other industry analysts, who anticipate that the Federal Reserve's potential rate cuts could ease the mortgage rates slightly.

The National Association of Realtors echoes this outlook, projecting that mortgage rates will average around 6.8% in the first quarter of 2024, with a gradual decrease to 6.1% by the year's end.

Fed Watch:

Target rate (in bps) possibilities, according to the CME Group:

|

Upcoming Federal Reserve Meeting Dates |

Current (5.25% - 5.50%) |

0.25% Reduction (5.00% - 5.25%) |

0.5% Reduction (4.75% - 5.00%) |

|

May 1st |

93.6% |

6.4% |

0% |

|

June 12th |

90.5% |

9.3% |

0.2% |

|

July 31st |

68.1% |

29.4% |

2.5% |

Market Review:

Per Black Knight's Production Metrics, the breakdown of mortgage production volume is as follows: 88.80% for purchase transactions, 8.77% for cash-out refinances, and 2.43% for rate and term refinances.

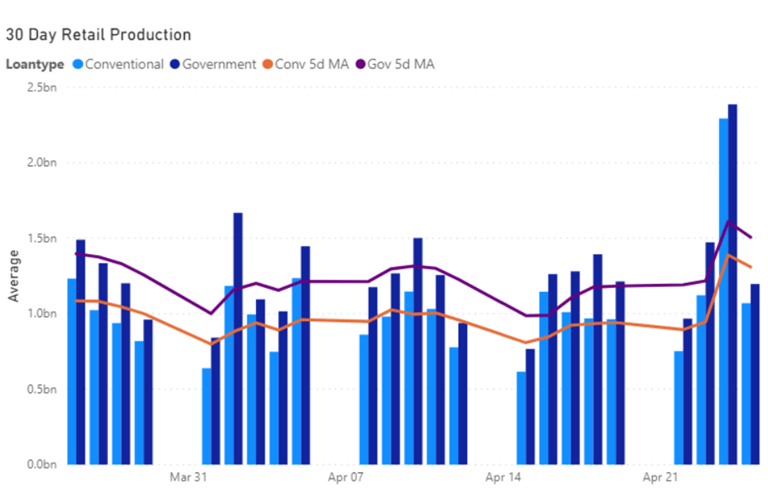

Per Black Knight 50.32% of all Retail loan production were Government Loans (FHA, VA, USDA), while 49.68% were Conventional and Non-Conforming loans.

Receding Recession

In an early April survey of business and academic economists, the percentage predicting a recession within the next two years declined from 39% three months ago to 29%. This is the lowest percentage since 4/22 when recession chances were pegged at 28%. Better yet, just 10% expect at least one quarter of negative growth over the next 12 months, down from 33% in January. I’m also slightly more optimistic.

- Elliot F. Eisenberg, former Sr. Economist with National Association of Home Builders

News You Can Use:

- The Fed's Key Inflation Rate Sizzles As GDP Slows; S&P 500 Slides

- Housing experts say there just aren't enough homes in the U.S.

- Pending Home Sales Ascended 3.4% in March

- The No. 1 Housing Market To Watch Is One Most Americans Probably Haven’t Heard Of

- Home shoppers seeing major price cuts, report shows

- ‘A Squatter and Her Goat Refused To Leave My San Antonio Home—This Is How I Got Rid of Them’

*Communication is intended for Industry Professionals only and not intended for Consumer Distribution

Interest rate and annual percentage rate (APR) are based on current market conditions as of 04/25/2024, are for informational purposes only, are subject to change without notice and may be subject to pricing add-ons related to property type, loan amount, loan-to-value, credit score and other variables. Estimated closing costs used in the APR calculation are assumed to be paid by the borrower at closing. If the closing costs are financed, the loan, APR and payment amounts will be higher. Contact us for details. Additional loan programs may be available. Accuracy is not guaranteed, and all products may not be available in all borrower's geographical areas and are based on their individual situation. This is not a credit decision or a commitment to lend. actual interest rate, APR, and payment may vary based on the specific terms of the loan selected, verification of information, your credit history, the location and type of property, and other factors as determined by Prosperity Home Mortgage, LLC. Not available in all states. Rate is as of 04/25/2024 and is subject to change at any time without notice. Opinions, estimates, forecasts, and other views contained in this document are those of Freddie Mac's economists and other researchers, do not necessarily represent the views of Freddie Mac or its management, and should not be construed as indicating Freddie Mac's business prospects or expected results. Although the authors attempt to provide reliable, useful information, they do not guarantee that the information or other content in this document is accurate, current, or suitable for any particular purpose. All content is subject to change without notice. All content is provided on an "as is" basis, with no warranties of any kind whatsoever. Information from this document may be used with proper attribution.

All first mortgage products are provided by Prosperity Home Mortgage, LLC. (877) 275-1762. Prosperity Home Mortgage, LLC products may not be available in all areas. Not all borrowers will qualify. Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act. Licensed by the Delaware State Bank Commissioner. Massachusetts Mortgage Lender License ML75164. Licensed by the NJ Department of Banking and Insurance. Licensed Mortgage Banker-NYS Department of Financial Services. Also licensed in AK, AL, AR, AZ, CO, CT, DC, FL, GA, ID, IL, IN, KS, KY, LA, MD, ME, MI, MN, MO, MS, MT, NC, ND, NE, NH, NM, NV, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VA, VT, WA, WI, WV and WY. NMLS ID #75164 (For licensing information go to: NMLS Consumer Access at http://www.nmlsconsumeraccess.org/)